Protection for...

|

Yourself

|

Family

|

Money

|

COVID19 UPDATE:

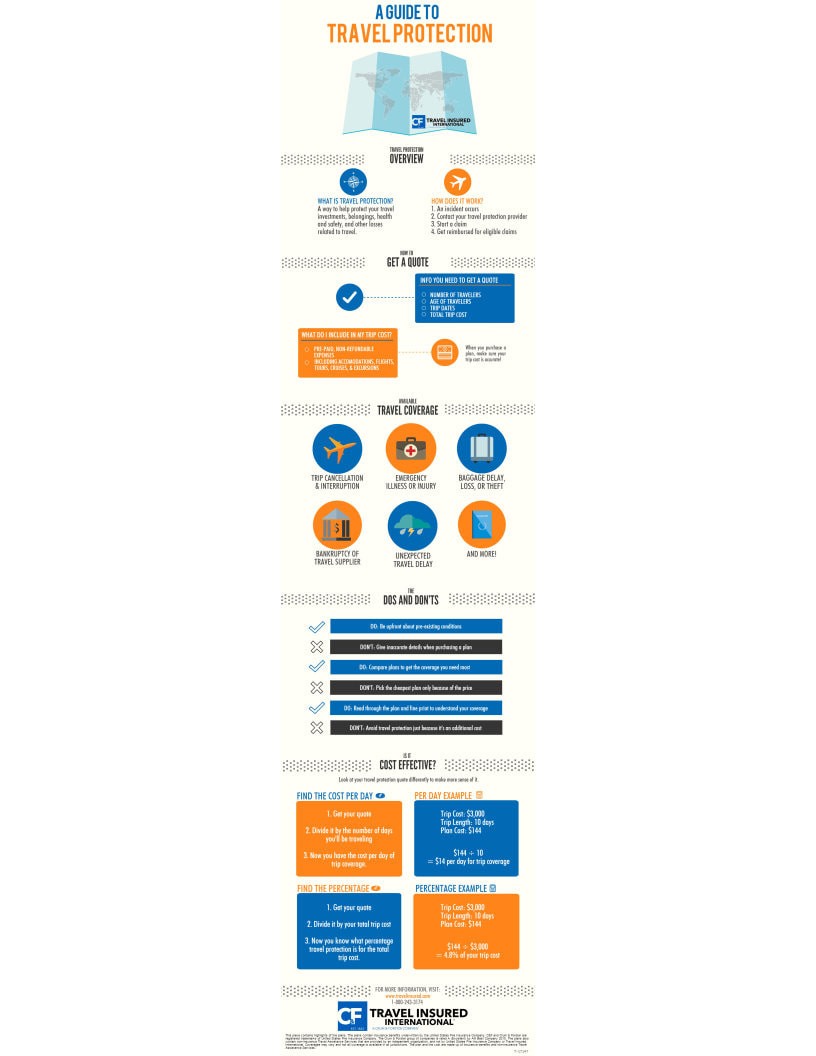

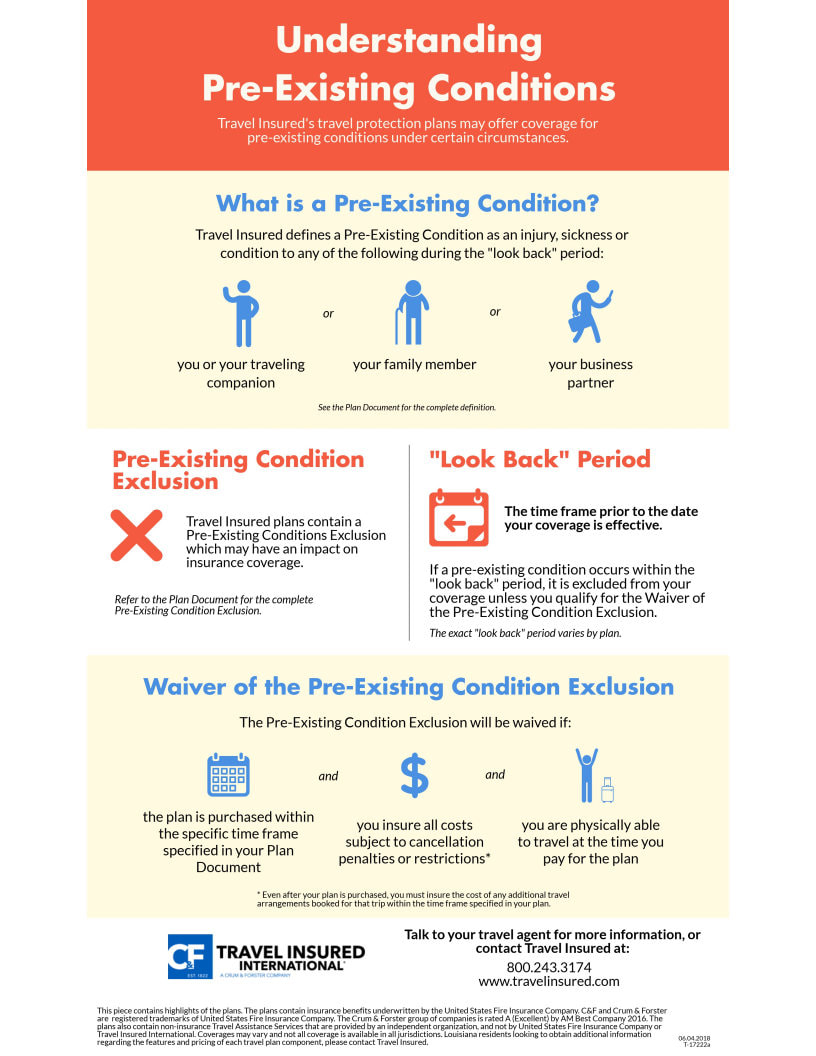

As frequent travelers ourselves we know there can be lots of loose ends and unforeseeable events that can derail a trip and incur extra expense and headaches. This is especially true with all the cancellations and trip interruptions and cancellations caused by the COVID19 worldwide pandemic. Travel insurance is highly recommended to help provide options and protect yourself, family and investment.

The best insurance policy option for COVID19 and other pandemics is to include a Cancel for Any Reason Coverage (CFAR) ryder in your policy which is offered by some travel insurance providers with varying coverage. CFAR coverage allows you to cancel your trip for up to 75% reimbursement of your covered, non-refundable trip cost, if the reason is not already covered by your plan.

CFAR policy ryders do have restrictions and usually must be purchased within 21 days of the date of your initial trip deposit. Additional terms apply.

As frequent travelers ourselves we know there can be lots of loose ends and unforeseeable events that can derail a trip and incur extra expense and headaches. This is especially true with all the cancellations and trip interruptions and cancellations caused by the COVID19 worldwide pandemic. Travel insurance is highly recommended to help provide options and protect yourself, family and investment.

The best insurance policy option for COVID19 and other pandemics is to include a Cancel for Any Reason Coverage (CFAR) ryder in your policy which is offered by some travel insurance providers with varying coverage. CFAR coverage allows you to cancel your trip for up to 75% reimbursement of your covered, non-refundable trip cost, if the reason is not already covered by your plan.

CFAR policy ryders do have restrictions and usually must be purchased within 21 days of the date of your initial trip deposit. Additional terms apply.

Please don't gamble with your health or money, contact us today to know what your options are.

Helpful tips and info